Holiday Turns: Emperical Data

Market Summary: 6/27/15

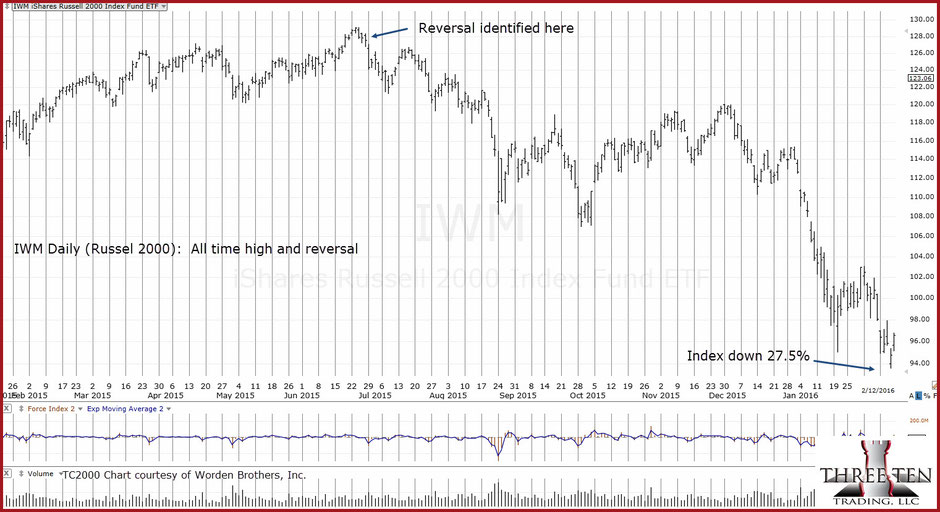

The Russell 2000 index has reversed. In addition, the S&P 500 volatility has declined to pre-2008 crisis levels. We now have yet another potential reversal during or just prior to (or just after) a holiday week.

This is how the Russell looked when the reversal was identified.

Other notable reversals that occurred prior to, during, or just after a holiday week:

- Week of 5/23/08: S&P 500 makes a high on the Monday prior to Memorial Day: S&P then crashes over 53%.

- Week of 7/3/14: Russell 2000 makes a high on the Tuesday of the July 4th week: Subsequent decline is 9%

- Week of 9/5/14: Russell 2000 makes a high on the Wednesday after the Labor Day weekend: Subsequent decline is 12%

- Week of 6/26/15: Russell 2000 makes a high on the Wednesday prior to the July 4th week: Subsequent decline: 27%

- Going way back: The all time market high of 1929, occurred on September 3rd, of that year. That date was the Tuesday following the Labor Day Weekend. Subsequent decline was 84 - 89%

Updated IWM (Russell 2000), from time of reversal identification to the low: